The bustling streets of Warsaw hummed with excitement as the country’s stock market, known as the Warsaw Stock Exchange or GPW, witnessed a remarkable surge in its key index, the WIG30. Investors and traders alike were buzzing with anticipation and energy as they tracked the upward trajectory of Poland’s financial landscape.

A Positive Turn of Events

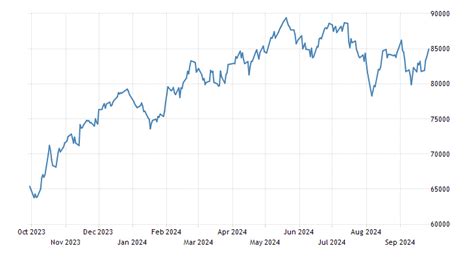

In a surprising turn of events, the WIG30 soared by an impressive 3.14% at the close of trading hours, signaling a bullish trend that captivated market participants. This substantial increase not only reflected investor confidence but also hinted at underlying economic strengths driving Poland’s growth story.

As news spread like wildfire across trading floors and financial news outlets, analysts scrambled to dissect the factors contributing to this sudden upswing. Experts pointed to several key drivers propelling Poland’s stock market rally, ranging from robust corporate earnings to favorable economic indicators and strategic government policies fostering a conducive business environment.

Expert Insights on Market Dynamics

Renowned financial experts weighed in on the unfolding market dynamics, offering their valuable perspectives on what fueled this significant uptick in stock prices. According to Dr. Anna Kowalski, an esteemed economist specializing in Eastern European markets, “Poland’s stellar performance can be attributed to a combination of factors such as increasing foreign investments, sound fiscal policies, and steady GDP growth.”

Dr. Kowalski further emphasized that geopolitical stability and Poland’s positioning as a regional economic powerhouse have played pivotal roles in attracting investors seeking lucrative opportunities within Central Europe. This alignment of internal resilience and external attractiveness has undoubtedly bolstered investor sentiment and injected vitality into the Polish stock exchange.

Market Sentiment and Investor Confidence

Amidst the jubilant atmosphere pervading trading floors, one could discern a palpable sense of optimism radiating from both seasoned investors and novice traders dipping their toes into the realm of stocks for the first time. The prevailing sentiment seemed buoyant yet cautious, with whispers of potential future gains mingling with prudent risk assessment strategies.

Veteran trader Mark Novak shared his perspective on investor behavior during such exuberant times: “It is crucial for investors to maintain a balanced approach when navigating volatile markets like these. While optimism fuels enthusiasm, it is essential to exercise prudence and conduct thorough research before making investment decisions.”

Challenges on the Horizon

However, seasoned market observers also acknowledged that amidst this euphoria lay certain challenges lurking on the horizon – from global economic uncertainties to shifting trade dynamics impacting Poland’s export-oriented industries. As dusk descended over Warsaw’s skyline, conversations veered towards how sustainable this bullish momentum would be in light of evolving market conditions.

As investors bid farewell to another eventful day at the stock exchange, whispers lingered about what tomorrow might unveil – would Poland continue its upward trajectory or face unforeseen obstacles? Only time would tell as players in this intricate financial ecosystem braced themselves for whatever twists and turns lay ahead.

In conclusion,

the remarkable surge witnessed by Poland’s stock market remains emblematic

of not just numerical gains but also underlying narratives

of resilience

economic prowess

and investor confidence.

This captivating tale continues

to unfold against

the backdrop

of global market fluctuations

and domestic imperatives guiding

Poland’s journey towards

financial prosperity.

Leave feedback about this