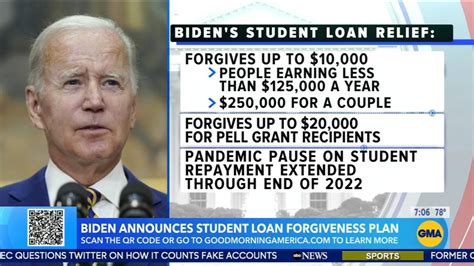

The fate of President Joe Biden’s federal student loan forgiveness program is hanging in the balance as the Supreme Court deliberates on delivering up to $20,000 of debt relief for millions of borrowers. The administration launched the application process last October, but an ongoing legal battle has put a pause on any debt cancellations.

Challenges and Eligibility

Legal challenges from various parties have complicated the rollout of the forgiveness program. Only federally held student loans qualify for relief, leaving out borrowers with private loans. Additionally, high-income individuals may not be eligible for full debt forgiveness.

Individuals earning under $125,000 annually or couples making less than $250,000 could see up to $10,000 in debt relief. Those who also received a federal Pell grant during their college years might qualify for up to $20,000 forgiveness – a lifeline for many struggling borrowers.

Expert Analysis:

Financial experts believe that targeting lower-income households and Pell grant recipients aligns with efforts to address economic disparities exacerbated by rising education costs. However, excluding private loan holders raises questions about equity in access to relief programs.

Legal Battles and Timeline

The Supreme Court heard arguments on the program’s legality due to concerns over the Department of Education’s authority. Lawsuits challenging the initiative have caused delays in implementing the debt relief plan. A final decision is anticipated by mid-2023 after months of legal back-and-forth.

While 16 million applications await approval pending court rulings, uncertainty looms over when actual debt cancellation will take effect. Borrowers are advised to monitor updates closely as they navigate through potential changes in repayment obligations.

Application Process and Debt Relief

If approved by the courts, an estimated 8 million borrowers could receive automatic debt relief based on pre-existing income records at the Department of Education. For others seeking assistance under Biden’s plan, submitting applications online will be crucial before set deadlines later this year.

For those wondering if past payments made during pandemic pauses can be refunded – there is hope! Borrowers who continued paying during these periods can request refunds directly from their loan servicers.

Insightful Observation:

As policymakers push for more borrower-friendly repayment options like reduced percentages of discretionary income caps and shorter forgiveness timelines, there is cautious optimism among student loan holders anticipating concrete benefits from proposed changes.

Tax Implications and Repayment Plans

Under current legislation passed by Congress in 2021, forgiven student loan amounts may not incur federal taxes but could trigger state tax liabilities depending on individual tax laws. Borrowers should assess potential tax consequences before applying for forgiveness programs

Furthermore,

plans are underway for revised income-driven repayment structures that aim to alleviate monthly payment burdens while offering quicker paths towards full balances clearance within a decade – a significant departure from existing frameworks widely criticized for prolonged repayment durations.

Valuable Tip:

Students contemplating enrollment or currently pursuing higher education should stay informed about evolving policies that might impact their future financial obligations related to student loans.

Through these ongoing developments within student loan initiatives spearheaded by President Biden’s administration,

millions stand poised at the cusp of potentially life-changing opportunities amidst lingering uncertainties surrounding complex legal battles dictating paths forward regarding much-needed financial reprieves.