Continental AG, a leading German auto supplier, recently announced projections indicating a potential 7% decline in the production of light vehicles in North America during the first quarter. This forecast was attributed to “economic uncertainty” and concerns regarding impending tariffs within the automotive sector.

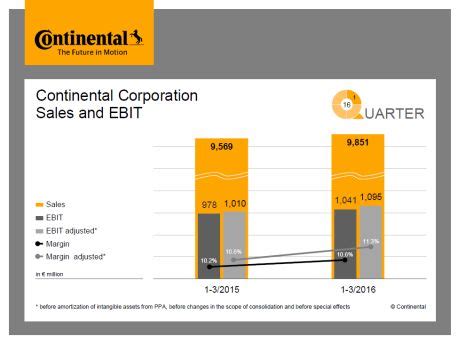

In a summary provided after a routine call with analysts and investors ahead of their quarterly results, Continental shared insights into various aspects affecting their automotive division. They anticipate that the adjusted margin on earnings before interest and tax will likely reach break-even levels within the initial three months of the year.

The company is scheduled to officially unveil its first-quarter results on May 6th, offering stakeholders a comprehensive overview of their financial performance during this period.

Expert Insights:

Expert Analysis:

Renowned industry analysts have emphasized how fluctuations in production figures can serve as key indicators of broader economic trends. The anticipated decline in vehicle manufacturing reflects the intricate interplay between market forces, regulatory policies, and consumer demand.

Market Speculation:

Speculation regarding potential impacts from tariffs has been rife within investment circles. Analysts are closely monitoring Continental AG’s developments as they navigate through this challenging landscape.

As news of these projections spreads across financial markets, investors are assessing their positions and considering potential shifts in the automotive sector. Such forecasts often trigger reactions among shareholders and industry players alike.

Amidst these dynamics, there is an underlying curiosity surrounding how Continental AG plans to mitigate risks associated with fluctuating production numbers. Their strategies for navigating uncertainties while maintaining operational efficiency will be under scrutiny by both investors and competitors alike.

In an ever-evolving economic environment marked by global trade tensions and regulatory changes, adaptability remains paramount for companies like Continental AG as they strive to sustain growth amidst external challenges.

From an investor’s perspective, understanding these market forecasts provides valuable insights into potential opportunities or risks within the automotive industry. It underscores the importance of staying informed about macroeconomic factors that could influence investment decisions.

As Continental AG prepares to disclose its quarterly outcomes, stakeholders eagerly await further details on how the company fared amidst prevailing market conditions. The narrative unfolding around North American light vehicle production serves as a microcosm reflecting broader economic narratives shaping industries worldwide.

Leave feedback about this