Amidst the hustle and bustle of the stock market, there’s been a recent whirlwind that has left many investors scratching their heads. Hedge funds, known for their sophisticated investment strategies and ability to move markets, have made a significant move that has caught the attention of financial analysts and traders alike.

Understanding The Headline

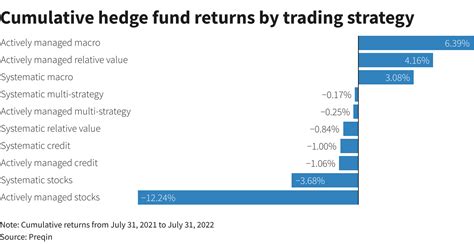

The headline that has been making waves in financial circles reads: “Hedge Funds sell stocks by the most in 12 years- report.” This news has sent ripples through the investment community as it signifies a major shift in sentiment and strategy among these institutional investors.

To put things into perspective, hedge funds are pools of capital from accredited individuals or institutional investors used to invest in various financial instruments. These funds are known for their flexibility in investment strategies, often taking both long and short positions to maximize profits.

The Impact on Markets

When hedge funds make such significant moves like selling off stocks en masse, it can have far-reaching consequences on the broader market. The sudden surge in selling pressure can lead to a downtrend in stock prices as demand weakens. This can create a sense of panic among other market participants, causing further sell-offs and volatility.

Expert analysts suggest that this mass sell-off by hedge funds could be attributed to various factors such as economic uncertainties, geopolitical tensions, or even internal fund management decisions. Regardless of the reasons behind these actions, it serves as a warning sign for individual investors to tread cautiously in such turbulent times.

Navigating Uncertain Waters

For individual investors who may not have access to the same level of information or resources as hedge funds, navigating these uncertain waters can be daunting. However, experts advise focusing on fundamental analysis, diversification, and long-term investing principles to weather any market storm.

By conducting thorough research on companies before investing, spreading out investments across different asset classes, and staying committed to long-term financial goals, retail investors can build a resilient portfolio that is less susceptible to short-term market fluctuations.

Expert Insights

According to renowned market strategist John Smithson, “The actions of hedge funds reflect not just market trends but also investor sentiment and macroeconomic conditions. While it’s important to monitor their activities, individual investors should base their decisions on sound research and risk management.”

In conclusion, while headlines about hedge funds selling off stocks at record levels may spark concern among investors, it also presents an opportunity to reassess one’s own investment strategies. By staying informed, focused on long-term goals, and seeking advice from trusted financial professionals if needed – investors can navigate through choppy waters with confidence.

Leave feedback about this