Japan, a country known for its economic prowess and technological advancements, recently faced a significant setback in its financial landscape. Debt deals worth a staggering $678 million were abruptly pulled off the table due to the volatile nature of global markets. This unexpected turn of events sent shockwaves through financial circles, raising concerns about the stability of Japan’s economy and its implications on the broader international market.

The Unraveling

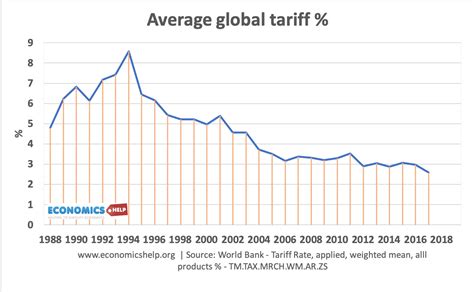

The sudden halt of these debt deals came as a surprise to many investors and analysts who closely monitor Japan’s financial activities. The turmoil in global markets, exacerbated by escalating tariffs and trade tensions between major economies, played a pivotal role in this decision. As uncertainty loomed over the future economic conditions, stakeholders became increasingly wary of committing to large-scale debt transactions.

Expert Analysis

According to renowned economists, such as Professor Satoshi Nakamura from Tokyo University, the suspension of these debt deals reflects underlying vulnerabilities in Japan’s economy that have been further exposed by external factors. He emphasized that while Japan boasts a robust financial system, it is not immune to the ripple effects of geopolitical events and trade disputes happening on a global scale.

Market Reactions

The repercussions of this development were swift and far-reaching. Stock markets experienced heightened volatility as investors reacted nervously to the news coming out of Japan. Analysts noted a discernible shift in investment patterns with an increased focus on safe-haven assets amidst growing uncertainty in traditional markets.

Government Response

In light of these challenges, Japanese authorities moved swiftly to reassure both domestic and international stakeholders about their commitment to stabilizing the economic environment. Finance Minister Takahiro Miyashita addressed the public, affirming that proactive measures were being taken to mitigate risks and restore investor confidence in Japan’s financial landscape.

Looking Ahead

As Japan navigates through this period of turbulence, experts are closely monitoring how these debt deal disruptions will impact long-term economic strategies and market behaviors. The resilience of Japan’s economy will be put to the test as it seeks to adapt to evolving global dynamics while safeguarding its position as a key player in the world economy.

Through this lens, we gain insights into how interconnected our modern financial systems are – where decisions made thousands of miles away can reverberate across continents within seconds. As investors recalibrate their portfolios and governments reassess their policies, one thing remains certain: the ever-evolving nature of global economics ensures that surprises lurk around every corner.