In the tumultuous world of global markets, a storm is brewing, and its name is tariffs. President Trump’s recent tariff decisions are causing ripples that are quickly turning into waves, crashing against the shores of economies worldwide. The repercussions of these actions are far-reaching and impactful, leaving investors scrambling to make sense of the chaos unfolding before their eyes.

“Yesterday’s markets sell-off was one for the record books, with tariff uncertainty on the rise.”

As news broke about escalating trade tensions and looming tariff threats, panic ensued among investors. The specter of trade wars loomed large, casting a shadow over financial stability. The uncertainty surrounding these tariffs has sent shockwaves through stock markets, resulting in a staggering $2.5 trillion loss from the S&P 500 alone. This massive hit serves as a stark reminder of the fragility of our interconnected global economy.

“Investors are bracing for another nerve-racking ride after Thursday’s sell-off vaporized $2.5 trillion from the S&P 500 on fears of trade wars.”

The aftershocks of this market meltdown are being felt worldwide, with stocks plummeting not only in the U.S. but also across Asia and Europe. The anxiety stemming from these events is palpable as investors grapple with uncertainties surrounding inflation rates and concerns about slowing global growth.

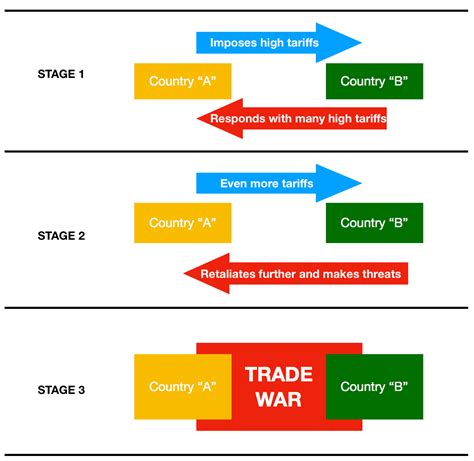

Amidst this turmoil, Beijing made a bold move by announcing an additional 34 percent tariff on U.S. imports—an action that sent shockwaves through an already fragile market ecosystem. This development further exacerbated fears among investors who were already reeling from the previous day’s losses.

“The yield on the 10-year Treasury bond plummeted below 4 percent on concerns that tit-for-tat moves would plunge the economy into a recession.”

The economic landscape is fraught with tension as experts warn of potential recessions triggered by retaliatory tariff measures between nations. The ripple effect of these decisions extends beyond just stock prices—it penetrates deep into interest rates and bond yields, creating a climate of uncertainty that threatens to destabilize financial markets globally.

On top of all this turmoil comes news that President Trump is considering levying additional tariffs on key sectors such as semiconductors and pharmaceuticals—a move that could have far-reaching implications for businesses both at home and abroad.

“Shares in Novo Nordisk fell sharply in Copenhagen following President Trump’s new round of levies.”

The impact of these decisions reverberates throughout various industries, leading to fluctuations in stock prices and investor confidence. Companies like Novo Nordisk are feeling the heat as they navigate through this unpredictable terrain wrought by shifting trade policies.

As economists eagerly await Friday’s jobs report, all eyes are on how recent events will shape employment numbers amidst rising uncertainties in various sectors impacted by tariff hikes and global trade tensions.

“Economists predict that Friday’s jobs report will show an additional 125,000 positions created last month.”

Despite challenges posed by geopolitical strains and economic instability brought about by tariffs, there remains hope for resilience within financial markets—where volatility often breeds opportunity for those willing to weather the storm.

In times like these when uncertainty reigns supreme in financial circles worldwide due to escalating trade tensions sparked by political decisions around tariffs—investors must exercise caution while navigating choppy waters ahead.

Leave feedback about this