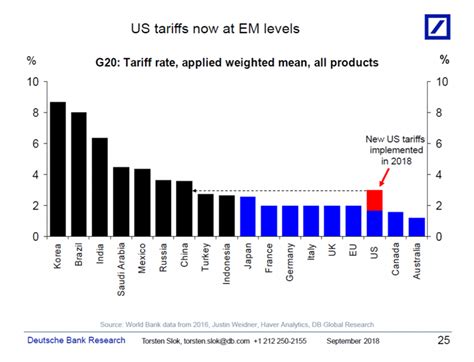

The recent tariff shock has left many experts reevaluating the economic landscape of the United States. In a surprising turn of events, some industry leaders are drawing parallels between the US economy and that of emerging markets. The implications of this comparison are vast and have sparked discussions across financial circles.

Expert Analysis:

“The US economy’s current trajectory is reminiscent of what we typically see in emerging markets after significant shocks,” remarked the CEO of Euronext, a leading European stock exchange. This statement has raised eyebrows among economists worldwide as they dissect its potential ramifications.

To truly understand this viewpoint, we must delve into the nuances of both established economies and emerging markets. Traditionally, developed nations like the United States have been characterized by stability, robust infrastructure, and mature financial systems. On the other hand, emerging markets often exhibit higher volatility, rapid growth potential, and susceptibility to external shocks.

Contextual Background:

The imposition of tariffs on various imports into the US has sent ripples through global trade dynamics. As retaliatory measures unfold and market uncertainties loom large, investors are closely monitoring how these changes will impact the overall economic health of the country.

Amidst these developments, industry leaders like the CEO of Euronext play a pivotal role in offering insights that shed light on potential scenarios unfolding within the US economy.

In times like these where conventional wisdom is being challenged by evolving economic paradigms, it becomes crucial to analyze differing perspectives for a comprehensive understanding.

Analyzing Economic Trends:

While comparisons to emerging markets may seem alarming at first glance, it is essential to recognize that every economic shift brings forth unique opportunities and challenges. By examining how the US adapts to these changing circumstances, experts can glean valuable insights into future trends.

As investors navigate uncertain waters post-tariff shock, adaptability and foresight become key attributes for success in today’s volatile market environment.

Through ongoing dialogue and expert commentary such as that provided by the Euronext CEO, stakeholders can gain a more nuanced understanding of the evolving economic landscape – paving the way for informed decision-making.

In conclusion, as discussions surrounding the state of the US economy continue to evolve post-tariff shock, it is imperative for stakeholders to remain vigilant yet proactive in navigating these uncharted territories with resilience and strategic foresight.

Leave feedback about this